Your brand is your most valuable asset. So how do you know if it's winning hearts and minds? How does it stack up against the competition? Do you know who your customers really are and what drives their consumption?

In this webinar you will learn

Here’s a little summary of some of the subjects we cover in this webinar

This webinar explores how to perform the five key data analysis frameworks for building a brand strategy:

- Competitive market structure analysis

- Acquisition Funnel Audit

- Profiling the core consumer

- Importance-Performance Analysis

- Basic Brand Vulnerability Matrix

Transcript

I'm going to walk you through five frameworks for extracting insight from data to help build strategies for brands. In this webinar we will be reviewing these five analysis frameworks converting your data into brand strategies.

I'm going to be showing you everything in Displayr, but the principles are applicable regardless of which software you use.

Most of the clever ideas that I am going to share with you come from the lead author on the eBook that we also have available, Andrew Kelly, who is a long-time user of Q. For those of you that love Smart Tables, he's the guy that told us to build it.

Competitive Market Structure Analysis

The first of the frameworks is the one that most of you will already know, which is competitive market structure analysis. However, I will show you a few technical things that I'm pretty sure will be new to just about everybody on the webinar.

Data requirement: Brand Attribute Grid with brands in the rows

There are a variety of possible data inputs for competitive market structure analysis, and we review them in the eBook. But, most of the time, we are best off using a brand attribute grid, like this one. And, we want to have the brands in the rows.

Data requirement: Market Share + Change in Share

We also want tables showing the market share of each brand and the change in market share over time so that we can understand dynamics

Market map

Let's now create a market map to explore the competitive market structure. We start with correspondence analysis.

In Displayr:

Insert > Dimension Reduction > Correspondence Analysis of a Table

We hook it up to our table. Next step is to set the row normalization to row principle scaled, which ensures that the map most accurately show the relationships between the brands.

In Displayr:

Normalization: Row Principal (Scaled)

Through the rest of this webinar we are going to treat Burger Chef as our client. You can see it here in the middle of the map. If you are experienced at correspondence analysis, you will know that the brands at the middle of the map are the ones that are least accurately represented by the map. So, we have a problem, as the brand we care about is not being accurately displayed.

Fortunately, this can be solved by rotating the correspondence analysis to maximize its explanation of Burger Chef. And, doubly fortunately, this is easy to do.

At the moment the attribute of “Has healthy food options” is standing out. It is owned by the brand Arnold’s. But we also have a problem, which is that it is an outlier. That is, it's not close to anything else. This means that it is likely distorting lots of other things on the map. So we need to remove it and see what happens.

We deleted Healthy Food options because it was an outlier. But we don't want to lose this information, so we will add it as a textbox.

In Displayr:

Insert > Text Box > Health food options RETURN (Arnold's only)

- Green

- Position to the right of Arnold's

Now let’s add market share as bubbles

In Displayr:

- Output: Bubble chart

- Sizes: market.share

And let's color the bubbles to show the change in share over time, with red marking decline and blue growth.

In Displayr:

- Bubble colors: share.change

- Set midpoint to: Zero

OK, let's work out what it is telling us. Looking at the top left, we can see that Burger Shack is all about quality food. And off to the right we also have attributes related to restaurant quality. And also, “Taste”.

On the opposite side of the map we have the convenience and value attributes, and there's also a “Variety” dimension, which Ma's and South Fried Chicken are doing well on.

So, to summarize:

- Burger Chef's main competitor is Arnold's. They are most strongly competing in terms of convenience and value, and as the three biggest competitors are all near convenience and value, this is the core set of twin benefits benefit in the market

- The smaller brands are growing however, which we can see by the blue shading. And they are more oriented towards quality, so we are perhaps seeing a long term shift in the market.

But, don't forget that

- Burger chef's top competitor is Arnold's and that is all about convenience and value,

- The secondary competitor seems to be southern fried chicken, where variety becomes relevant.

Acquisition Funnel audit

So, we know who we need to focus on. Let's move onto our second framework to work out what to do.

Funnel stages and conversion

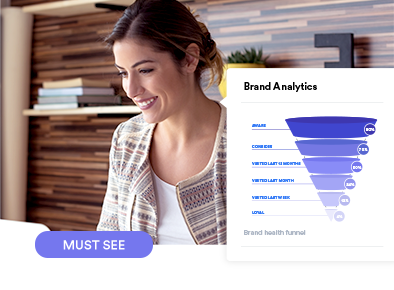

Just about all customer acquisition processes can be viewed as funnels. Series of sequential stages, wherever fewer people squeeze through. In packaged goods markets the best funnels relate to frequency of visiting and the hierarchy of effects. An example is shown on the left. In B2B software sales by contrast, good funnels can relate to a combination of the depth of data and stage in the purchase process.

Conversion is just the ratio of the numbers at one stage over the previous stage. So, in the funnel on the left we have 90% conversion from visited last trip to being loyal. In the one on the right we have 25% conversion from being in the CRM through to having received a demo. The key to performing an effective acquisition funnel audit is to compare conversion rates. You can compare them over time, against benchmarks, or against competitors, which is what I’m going to show now.

X-Axis (horizontal): Consider..

One of the most interesting conversions to look at is the conversion of consideration to most recent visit. The conversion rates for each brand are just this table on right divided by this table. We will compute these with some simple R code

In Displayr:

Insert > R Output

conversion =

Copy the name of the table on the left

Click into R code box and paste

Copy second table and paste

OK, so we now have the conversion rates. To interpret these properly it's best to view them on a scatterplot. I'll first just free up some space and move the tables to below the page.

In Displayr:

Insert > Visualization > Scatter

X coordinates: table…consider.2

Y coordinates: conversion

Can you see how all of the brands are ordered from on a diagonal line going up to the right?

In Displayr:

Insert > Shape > Line, and draw it through the points

This isn't a coincidence. It happens in just about all markets. It's called double jeopardy. If you do bad on one metric you tend to do bad on all of them.

The interesting insights always come from looking at the patterns after double jeopardy has been factored in. So, looking here we can see that Arnold's is doing amazingly well, even with double jeopardy, while Asian food and Pret'a'pane are doing really bad.

The trick is then to work out why. Common explanations for such deviations relate to distribution and pricing.

Viewing multiple stages at once

We can get good insights into branding issues by viewing all the stages of conversion at the same time. Here you can see I've got the data for four stages. I can glue them together by clicking here

In Displayr:

Insert> More > Marketing > Brand Health table

Output in pages: Select

Row names

-

-

- Aware

- Trial

- Consider

- Most recent oder

-

Sort by: row 4

Show as: Bars

Funnel stage conversion by brand

I've color coded the various conversion metrics to show departures from double jeopardy.

So, what does Burger Chef have to do? Its awareness is the same as its' two key competitors of Arnold's and Southern Fried Chicken. Its conversion to Ever purchased and consider are a bit below Arnold's, but that's what we would expect due to double jeopardy.

Where it is in real trouble is in terms of conversion from consider to most recent order, so we need to focus on increasing our volume.

Profiling the core consumer

Marketing 101 is that you can't target everybody. You need to focus your marketing efforts. Marketing 201 is segmentation. But there is a stage before segmentation, which is to define the core consumers. There are at least four different ways of defining the core consumer:

- You can focus on the consumers who should like your product the most. For example, this is how software marketing and sales is often done.

- You can focus on innovators.

- You can focus on influencers, as is done in fashion markets

- Or, most commonly, you can define the core as the heaviest consumers in the category, which is what I will illustrate. As that’s the only way for burger chef to close the gap on Arnold’s.

Distribution of consumption volume

We need to start by finding or creating a variable that measures volume of consumption

I've got a variable showing how many times they went to a burger restaurant in the last month.

In Displayr:

Drag across # Burger Occasions Capped at 50

Chart> Histogram

So, it is this trail of people, consuming more than 4.8 meals at burger restaurants a month that we want to find.

Finding the core: Classification and Regression Trees

The best technique for finding them in my experience is to use CART.

In Displayr:

Insert > Machine Learning > CART

Outcome: # Burger occasions capped at 50

Select all:

- S1

- S2

- S3

- C1

- C2

- C3

- Income

Predictor category labels: Full labels

Here we get a nice Sankey tree visualization. We can see that the best predictor is age, with heavier users, shown in blue, being aged under 30. Age is then split by household structure, but the split's not so interesting, so I will ignore it. I do the same thing for the other split.

Profiling the core consumers: Bubble Chart

But we need a bit more info about these people in order to help with targeting. We'll start by creating a banner of all the demographic variables.

I particularly like this bubble chart for doing this. Each bubble size represents the proportion of the market. Their height indicates their average volume of consumption.

So, what we can see now is that our core consumers are:

- Under 30

- Single

- Work in services, sales, and as laborers,

- With low incomes

Importance-Performance Analysis

This is another framework that most people are well familiar with. We've given a detailed explanation of how to do it in our eBook on driver analysis. So, I'll cover it only quickly here and make a different point.

Importance-Performance Analysis: the basic idea

So, just in case you haven't seen this before, the basic idea is that you measure lots of possible ideas in terms of whether they are important to consumers and whether the brand does well. You want to have lots of things in the top right corner. Things in the bottom right corner are things you need to improve performance on.

Importance-Performance Analysis: Meal options

Most people only use the importance-performance framework to create quad maps from driver analysis. But the general principle's much more powerful. The basic idea is to find existing data that shows importance and performance wherever you can.

On the x-axis of this scatterplot I am showing the frequency of various activities. On the y-axis I am showing the market share of Burger Chef among people who did these behaviors.

Putting it all together now, we can see that we're only really missing out on one opportunity on this plot, which is Chicken Nuggets/Tenders.

Basic Brand Vulnerability Matrix

The basic brand vulnerability matrix is a useful tactical brand-based segmentation.

Basic Brand Vulnerability Matrix: The basic idea

The idea is to focus on the gaps between what people like and what people actually do.

Loyal buyers who like and buy the brand regularly need to be defended. All brands do have some consumers who don't like the brand. These need to be retained.

And, there are always some people who like the brand but don't buy it. They are blocked for some reason. We can grow share by unblocking them.

Defining and sizing the segments

To implement this framework, we need to obtain or create two variables. One measuring attitude. One measuring behavior. The size of segments is then taken from the total percentages of the crosstab of the two. Note that the segment of people that like and visit regularly is the same size as the one that like but don't visit at all!

Computing market share within the segments

After sizing the segments, we need to work out our share in each.

In Displayr

Dragging across Q6

Dragging across Brand attitude as a Column

Drag brand usage under brand attitude so it nests

Uncheck “add sub NETs” and “add column spans of variable set names”

So, remembering that we are focusing on Burger Chef, we see that its market share is in the second row. As we'd expect we have no market share among the non-buyers, and it grows with attitude. Not also that the people that didn't visit but like us, that there is a skew to Southern Fried Chicken here and Mexican, so we can consider options that would appeal to such buyers.

Now, in addition to having computed market share, the cool thing about this page is that we can use it is as template to understand differences between segments. We start by duplicating the whole page.

Let's replace the brand data with the food they ate.

The first interesting group to look at are those that dislike us but visited twice or more. The blue arrows tell us why. We've locked them in by being available with Breakfast and late-night snacks.

The next interesting group to look at are the ambivalent ones who didn't visit. They are skewing towards Dinner. Similarly, the Likes that didn't visit are also more likely to be eating at Dinner, suggesting we can unlock growth by targeting the dinner occasion.

Day of week isn't relevant. We can keep doing this one by one, or automated the process using crosstabs and automated stat testing.

What to focus on

Here's an example summarizing a whole host of analyses from the basic brand duplication matrix.

Summary

We've reviewed five frameworks for analyzing data to inform brand strategy.

Read more